The most trusted and complete loan data

MTA LoanTracs gives you fast, easy access to the most accurate, comprehensive and timely loan transaction data assembled in one place.

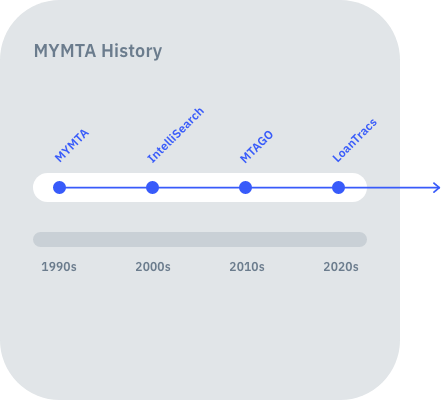

Trusted for 25+ years

MTA LoanTracs is powered by MyMTA, a pioneer in the real estate ranking industry. We were the first to begin tracking and ranking real estate agents in the early 90s, and now we’re applying our expertise in collecting, verifying, and reporting transaction data to ranking loan officers for better-informed decision making.

“Having access to MTA has been a complete game changer in building my realtor base within my business. I no longer needed to guess which real estate agents are doing the business. Now, with MTA LoanTracs, I have the same ability with Loan Officers.“

Jason Wojtyna, Arizona Loan Officer

“I’ve been using MTA for YEARS and years…I’ve been in the industry 27 years and you definitely are my GO TO!“

Gina Pappas, Nevada Title Insurance Rep

Clean, accurate data

Collecting raw data from every loan transaction on a daily basis is just the first step. MTA LoanTracs verifies loan amounts, standardizes lender and title company names, normalizes statistical information, merges redundancies, and reviews transactions to confirm data integrity. The end product is clear, consistent, current and correct data you can use to plan, prospect and recruit.

Turn statistical analysis into informed decisions

Compare loan officer performance by region and loan type

View detailed loan officer profiles, including contact info and performance stats

Search all loan officer activity nationwide

Spot market trends and anticipate sales opportunities

Analyze sales volume by loan officer, region and loan type

Benchmark your competitive performance and market share

Target geographical markets for expansion

Set watchlists and receive email alerts on loan officer activity

Comprehensive and up to date

No other source can give you the complete picture of market activity, because only MTA LoanTracs covers every mortgage loan, in every state, county, city, and zip code available nationwide. Whether you’re searching for loan officer performance data in large cities or small towns, in any kind of loan type, you can source it, search it, sort it and analyze it in one web-based resource.

Searchable, sortable, actionable loan officer data

Clean, clear data that is presented in context, with the ability to add loan officers to a watch list, delivering updates to your inbox as soon as key metrics change.

- State, County, City, Zip Code

- Loan Type

- Transaction Type

- Monthly Volume

- Coverage Dates

- Average Transactions

- Employment History

- NMLS ID

- Loan Officer Name

- Lenders